CAPITAL COSTS (TAX LEVY)

The total project cost is $4,195,255

as shown in the table below. This total include

administration, engineering, construction and a contingency.

This cost will be funded by a

State Revolving

Fund Loan backed by General Obligation bonds. The SRF loan

program has also told River Rock that $300,000 will be "forgiven" from

the loan repayment schedule. This reduces the amount the District

needs to borrow to $3,830,220. To issue the

bonds the District must pass a bond resolution, hold a public hearing

and conduct an election which must be passed by

it's residents and property owners. The District passed a bond

resolution on June 27, 2011. A copy of the full resolution is

provided at the link below. The election procedure is

discussed in more detail below.

» District Bond Resolution # 2011-11

|

RIVER ROCK COUNTY WATER & SEWER DISTRICT |

|

|

|

|

|

Wastewater Treatment Plant Upgrade Project |

|

|

|

|

|

Estimate completed by Anna Miller, Montana Dept. of Natural

Resources, State Revolving Fund (SRF) Loan Program |

June 23, 2011 |

| |

|

|

|

|

|

|

WWTP Project Estimates |

MONEY SOURCES |

TOTALS |

|

SRF Loan A1

$300,000 |

SRF

Loan B $543,220

@ 3.75% Int Rate |

SRF

Loan C $3,287,000

@ 3.75% Int Rate |

Local

from RRWSD |

|

Estimated Administrative & Finance Costs |

|

|

|

|

|

|

Personnel Costs |

$

6,000 |

$

6,000 |

$

- |

|

$

12,000 |

|

Office Costs |

|

$

300 |

$

- |

|

$

300 |

|

Professional Services |

$

7,500 |

$

7,500 |

$

- |

|

$

15,000 |

|

Legal Costs |

$

3,500 |

$

4,000 |

$

- |

|

$

7,500 |

|

Audit Fees |

$

- |

$

- |

$

1,200 |

|

$

1,200 |

|

Travel & Training |

|

$

- |

$

800 |

|

$

800 |

|

Debt Service Reserve |

$

- |

|

|

|

$

- |

|

Interim Interest |

$

- |

|

|

|

$

- |

|

Bond Counsel & Related costs |

$

15,000 |

$

- |

$

- |

|

$

15,000 |

|

Subtotal Admin/Finance Costs > |

$

32,000 |

$

17,800 |

$

2,000 |

$

- |

$

51,800 |

|

Estimated Activity Costs |

|

|

|

|

|

| PER

Update |

|

|

|

$

- |

$

- |

|

Preliminary Engineering |

|

$

- |

$

- |

$

65,035 |

$

65,035 |

|

Engineering/Arch. Design |

$

211,561 |

$

48,400 |

$

12,679 |

$

- |

$

272,640 |

|

Construction Engr. Services |

$

56,439 |

$

235,822 |

$

24,240 |

$

- |

$

316,501 |

|

Construction |

$

- |

$

241,198 |

$

2,912,044 |

$

- |

$

3,153,242 |

|

Contingency |

$

- |

$

- |

$

336,037 |

$

- |

$

336,037 |

|

Subtotal Project Activity Costs > |

$

268,000 |

$

525,420 |

$

3,285,000 |

$

65,035 |

$

4,143,455 |

|

TOTAL PROJECT COSTS > |

$

300,000 |

$

543,220 |

$

3,287,000 |

$

65,035 |

$

4,195,255 |

|

1 SRF

Loan A will be "forgiven" for repayment |

OPERATION & MAINTENANCE COSTS

(RATE BASED)

In addition to the capital costs, the project will add costs to

the annual operation and maintenance budget for the wastewater system.

The new plant will add depreciation costs for the new

equipment and added costs for labor, power and chemicals.

|

RIVER ROCK COUNTY WATER & SEWER DISTRICT |

|

|

Annual Replacement & Operation/Maintenance Cost Estimate |

|

|

July 21, 2011 |

|

| »

Click for Detail Cost Estimate |

|

| |

|

|

Annual Replacement Cost Estimates |

|

|

Membrane Replacement |

$21,427 |

|

Blower Replacement |

$6,025 |

|

Pump Replacement |

$13,889 |

|

Liner Replacement |

$12,401 |

|

Interior Valve And Piping Replacement |

$3,985 |

|

Exterior Valve And Piping Replacement |

$5,977 |

|

Miscellaneous Sludge Handling Infrastructure Replacement |

$1,612 |

|

Generator Replacement |

$7,444 |

|

Total Annual Replacement Costs > |

$72,761 |

| |

|

|

Annual Operating Cost Estimate |

|

|

Operating Costs- Power, Chemicals & Labor |

$90,154 |

|

Total Operating Power Costs > |

$90,154 |

| |

|

|

TOTAL ANNUAL COSTS TO SEWER RATE BASE > |

$162,915 |

| |

|

|

Estimated Impact on Monthly Sewer Rates |

|

|

Total Sewer Connections |

1,031 |

|

Monthly Increase per Connection [(Annual Cost/12)/Connections] |

$13.17 |

|

|

STATE REVOLVING FUND LOAN COSTS

The loan costs for a SRF loan for this project are shown below.

The loan amortization is based on a $3,830,220 over 20 years at

3.75%. The total loan repayment for principal and

interest is $5,571,060. The

annual debt service for this loan is estimated at $273,931.

The SRF loan will be backed by

General

Obligation Bonds (GO Bonds) which are secured by the District's taxing

authority. The Water & Sewer District will have to levy a tax

annually to collect enough money to make the annual payment.

|

Preliminary Schedule |

|

STATE OF MONTANA |

|

GENERAL OBLIGATION BONDS |

|

WASTEWATER |

|

(REVOLVING FUND PROGRAM) |

|

|

|

|

|

|

|

|

|

|

| |

|

BORROWER: |

RIVER ROCK WATER & SEWER DISTRICT |

|

|

|

| |

|

PROJECT NAME: |

WWTP Upgrade |

|

|

FINAL LOAN PAYMENT: |

7/1/2032 |

|

|

|

LOAN COMMITMENT: |

$4,130,220 |

|

|

# OF LOAN PAYMENTS: |

40 |

|

| |

|

LOAN AMOUNT: |

3,830,220 |

|

|

PROJECT NUMBER: |

Pending |

|

| |

|

INTEREST RATE: |

3.75% |

|

|

DATE OF FUNDING: |

10/1/2011 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

TOTAL |

TOTAL |

|

PMT |

PAYMENT |

LOAN LOSS |

ADM EXPENSE |

INTEREST |

PRINCIPAL |

O/S LOAN |

AMOUNT OF |

AMOUNT OF |

| # |

DUE |

RESERVE |

SURCHARGE |

PAYMENT |

PAYMENT |

BALANCE |

OF PAYMENT |

ANNUAL PAYMENT |

| 1

|

1/1/2013 |

$47,878 |

$35,908 |

$95,756 |

$65,149 |

$3,765,071 |

$229,412 |

$229,412 |

| 2

|

7/1/2013 |

$18,825 |

$14,119 |

$37,651 |

$66,370 |

$3,698,701 |

$136,965 |

|

| 3

|

1/1/2014 |

$18,494 |

$13,870 |

$36,987 |

$67,615 |

$3,631,086 |

$136,965 |

$273,931 |

| 4

|

7/1/2014 |

$18,155 |

$13,617 |

$36,311 |

$68,882 |

$3,562,204 |

$136,965 |

|

| 5

|

1/1/2015 |

$17,811 |

$13,358 |

$35,622 |

$70,174 |

$3,492,030 |

$136,965 |

$273,931 |

| 6

|

7/1/2015 |

$17,460 |

$13,095 |

$34,920 |

$71,490 |

$3,420,540 |

$136,965 |

|

| 7

|

1/1/2016 |

$17,103 |

$12,827 |

$34,205 |

$72,830 |

$3,347,710 |

$136,965 |

$273,931 |

| 8

|

7/1/2016 |

$16,739 |

$12,554 |

$33,477 |

$74,196 |

$3,273,514 |

$136,965 |

|

| 9

|

1/1/2017 |

$16,368 |

$12,276 |

$32,735 |

$75,587 |

$3,197,927 |

$136,965 |

$273,931 |

| 10

|

7/1/2017 |

$15,990 |

$11,992 |

$31,979 |

$77,004 |

$3,120,923 |

$136,965 |

|

| 11

|

1/1/2018 |

$15,605 |

$11,703 |

$31,209 |

$78,448 |

$3,042,475 |

$136,965 |

$273,931 |

| 12

|

7/1/2018 |

$15,212 |

$11,409 |

$30,425 |

$79,919 |

$2,962,556 |

$136,965 |

|

| 13

|

1/1/2019 |

$14,813 |

$11,110 |

$29,626 |

$81,417 |

$2,881,139 |

$136,965 |

$273,931 |

| 14

|

7/1/2019 |

$14,406 |

$10,804 |

$28,811 |

$82,944 |

$2,798,195 |

$136,965 |

|

| 15

|

1/1/2020 |

$13,991 |

$10,493 |

$27,982 |

$84,499 |

$2,713,696 |

$136,965 |

$273,931 |

| 16

|

7/1/2020 |

$13,568 |

$10,176 |

$27,137 |

$86,084 |

$2,627,612 |

$136,965 |

|

| 17

|

1/1/2021 |

$13,138 |

$9,854 |

$26,276 |

$87,698 |

$2,539,914 |

$136,965 |

$273,931 |

| 18

|

7/1/2021 |

$12,700 |

$9,525 |

$25,399 |

$89,342 |

$2,450,572 |

$136,965 |

|

| 19

|

1/1/2022 |

$12,253 |

$9,190 |

$24,506 |

$91,017 |

$2,359,555 |

$136,965 |

$273,931 |

| 20

|

7/1/2022 |

$11,798 |

$8,848 |

$23,596 |

$92,724 |

$2,266,832 |

$136,965 |

|

| 21

|

1/1/2023 |

$11,334 |

$8,501 |

$22,668 |

$94,462 |

$2,172,369 |

$136,965 |

$273,931 |

| 22

|

7/1/2023 |

$10,862 |

$8,146 |

$21,724 |

$96,233 |

$2,076,136 |

$136,965 |

|

| 23

|

1/1/2024 |

$10,381 |

$7,786 |

$20,761 |

$98,038 |

$1,978,098 |

$136,965 |

$273,931 |

| 24

|

7/1/2024 |

$9,890 |

$7,418 |

$19,781 |

$99,876 |

$1,878,222 |

$136,965 |

|

| 25

|

1/1/2025 |

$9,391 |

$7,043 |

$18,782 |

$101,749 |

$1,776,474 |

$136,965 |

$273,931 |

| 26

|

7/1/2025 |

$8,882 |

$6,662 |

$17,765 |

$103,656 |

$1,672,817 |

$136,965 |

|

| 27

|

1/1/2026 |

$8,364 |

$6,273 |

$16,728 |

$105,600 |

$1,567,217 |

$136,965 |

$273,931 |

| 28

|

7/1/2026 |

$7,836 |

$5,877 |

$15,672 |

$107,580 |

$1,459,637 |

$136,965 |

|

| 29

|

1/1/2027 |

$7,298 |

$5,474 |

$14,596 |

$109,597 |

$1,350,040 |

$136,965 |

$273,931 |

| 30

|

7/1/2027 |

$6,750 |

$5,063 |

$13,500 |

$111,652 |

$1,238,388 |

$136,965 |

|

| 31

|

1/1/2028 |

$6,192 |

$4,644 |

$12,384 |

$113,746 |

$1,124,642 |

$136,965 |

$273,931 |

| 32

|

7/1/2028 |

$5,623 |

$4,217 |

$11,246 |

$115,878 |

$1,008,764 |

$136,965 |

|

| 33

|

1/1/2029 |

$5,044 |

$3,783 |

$10,088 |

$118,051 |

$890,713 |

$136,965 |

$273,931 |

| 34

|

7/1/2029 |

$4,454 |

$3,340 |

$8,907 |

$120,264 |

$770,449 |

$136,965 |

|

| 35

|

1/1/2030 |

$3,852 |

$2,889 |

$7,704 |

$122,519 |

$647,929 |

$136,965 |

$273,931 |

| 36

|

7/1/2030 |

$3,240 |

$2,430 |

$6,479 |

$124,817 |

$523,113 |

$136,965 |

|

| 37

|

1/1/2031 |

$2,616 |

$1,962 |

$5,231 |

$127,157 |

$395,956 |

$136,965 |

$273,931 |

| 38

|

7/1/2031 |

$1,980 |

$1,485 |

$3,960 |

$129,541 |

$266,415 |

$136,965 |

|

| 39

|

1/1/2032 |

$1,332 |

$999 |

$2,664 |

$131,970 |

$134,444 |

$136,965 |

$273,931 |

| 40

|

7/1/2032 |

$672 |

$504 |

$1,344 |

$134,444 |

($0) |

$136,965 |

$136,965 |

| |

Totals > |

$468,298 |

$351,224 |

$936,596 |

$3,830,220 |

|

$5,571,060 |

$5,571,060 |

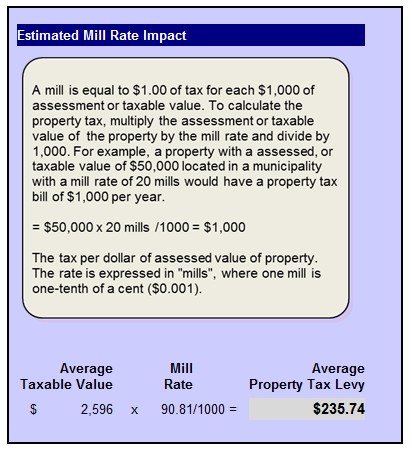

The tax levy estimate for the GO bond debt

service is shown in the 2 tables below. To calculate the mill rate

to collect $273,000 for bond debt service the total taxable value of the

District must be calculated. The District compiled a list of all

parcels in the District that included the market and taxable value for

each parcel. An excerpt from this list is shown below and a link to

the full list is provided below. The sum of all of the taxable

values from the 2010 tax year for all parcels in the District was

$3,016,565. Based on this taxable value it would require a mill

rate in the amount of 90.81 mills.

The full parcel list has a column that computes the estimated tax cost

for each parcel based on a 90 mill levy.

»

Full

River Rock Parcel List

|

RIVER ROCK SUBDIVISION PARCEL LIST & TAXABLE VALUES |

|

|

@ 90.81

Mills |

Tax

Year |

Tax

Parcel No |

Property ID |

User Type |

Market

Value |

Taxable

Value |

ESTIMATED

TAX PAID |

|

2010 |

CRARCONMST |

06-0903-03-4-44-07-7000 |

CONDO |

|

|

$0 |

|

2010 |

MMM5860 |

06-0903-03-4-18-37-8481 |

SFR |

$26,788 |

$755 |

$63 |

|

2010 |

MMM6168 |

06-0903-03-3-15-09-8055 |

SFR |

$25,041 |

$706 |

$59 |

|

2010 |

MMM6213 |

06-0903-03-4-17-69-8256 |

SFR |

$27,039 |

$762 |

$64 |

|

2010 |

MMM6227 |

06-0903-03-3-15-49-8001 |

SFR |

$14,479 |

$408 |

$34 |

|

2010 |

MMM6241 |

06-0903-03-3-16-31-8001 |

SFR |

$14,321 |

$404 |

$34 |

|

2010 |

MMM6303 |

06-0903-03-3-13-42-8056 |

SFR |

$14,429 |

$407 |

$34 |

|

2010 |

MMM6304 |

06-0903-03-3-15-13-8013 |

SFR |

$14,477 |

$408 |

$34 |

The "Market Value" that is shown on the list is

the market value that the Department of Revenue (DOR) assigns to each

parcel. It is not meant to be the value of what your property is

worth if you were to sell it today. The DOR put together a

pamphlet which explains property taxes that may be helpful in

understanding market and taxable values. The link is show below.

»

Dept of Revenue "Understanding Property Taxes"

The table below shows summary costs for the

average types of development in the District. River Rock has 222

condo units in it that have an average taxable value of $2,273, and 915

Single Family Residences (SFR) that have an average value of $2,748.

The average tax cost for all parcels in the District is $235.74 per year

based on the 2010 taxable value. This is equivalent to $19.65 per

month but would be paid twice per year on the semi-annual tax statements

that Gallatin County sends out.

|

Summary of Project Loan Costs & Tax Levy Estimate |

July 21, 2011 |

|

| |

|

|

|

|

|

|

|

|

|

LOAN DATA |

|

|

|

PARCEL DATA |

|

|

|

|

Total Project Cost for Loan |

$3,830,220 |

|

|

Total Market Value |

$110,283,584 |

|

|

|

| Max

Loan Term (Yrs) |

20 |

|

|

Total Taxable Value |

3,016,565 |

|

|

|

|

Interest Rate |

3.75% |

|

|

Total Parcels |

1,163 |

|

|

|

|

Total Principal |

$3,830,220 |

|

|

Total EDUs |

1,171.0 |

|

|

|

|

Total Interest |

$936,596 |

|

|

|

|

|

|

|

|

Total Loan Cost (P+I) |

$5,571,060 |

|

|

USER TYPE TOTALS & AVERAGES |

|

|

|

|

Average Annual P&I Payment |

$273,931 |

|

|

|

|

Total Market |

Total Taxable |

|

| |

|

|

|

USER TYPES |

# |

Value |

Value |

|

|

GENERAL OBLIGATION BOND % ASSUMPTION |

|

|

CONDO |

222 |

$17,893,981 |

$502,286 |

|

| %

to be funded by GO Bond |

100% |

|

|

PARK |

25 |

$1,711,912 |

$0 |

|

|

Loan Period (Years) |

20 |

|

|

SCHOOL |

1 |

$279,614 |

$0 |

|

|

Loan Interest Rate |

3.75% |

|

|

SFR |

915 |

$90,398,077 |

$2,514,279 |

|

|

Amount funded by GO Bond |

$

3,830,220 |

|

|

TOTALS > |

1,163 |

$110,283,584 |

$

3,016,565 |

|

|

Annual P&I Payment for GO Bond |

$

273,931 |

|

|

|

|

|

|

|

|

Mill Rate = |

90.81

|

Mills |

|

|

Average Market |

Average Taxable |

|

| Avg

Cost per Parcel/Year |

$

235.74 |

|

|

USER TYPES |

# |

Value |

Value |

|

| Avg

Cost per Parcel/Month |

$

19.65 |

|

|

CONDO |

222 |

$80,968 |

$2,273 |

|

| |

|

|

|

PARK |

25 |

$68,476 |

$0 |

|

| |

|

|

|

SCHOOL |

1 |

$279,614 |

$0 |

|

| |

|

|

|

SFR |

915 |

$98,796 |

$2,748 |

|

| |

|

|

|

TOTALS > |

1,163 |

|

$

2,596 |

|

| |

|

|

|

|

|

|

|

|

Mill Rate Estimate

This table shows how the mill rate is calculated. The

calculation at the bottom shows the mill rate for the average taxable

value of all parcels in River Rock.

|